CMHC Report Highlights the Importance of Supply to Making Housing Affordable Again

By: Diana Petramala

February 23, 2018

In case you missed it, The Canada Mortgage and Housing Corporation (CMHC) released a massive (PDF file) research report (external link) on the drivers of home price growth in Canada’s five largest metropolitan areas between 2010 and 2016. In the 200-page report, CMHC analysts provided a deep dive into the academic research available on housing markets around the world, as well as offering a model-driven approach to analyzing home price movements in Montreal, Toronto, Edmonton, Calgary and Vancouver. The overarching conclusion of the report was similar to CUR’s own findings over the years– that supply constraints accounted for an important component of the rise in home prices between 2010 and 2016.

Home prices can rise for many reasons, including lower mortgage rates, income and population growth and a shift in the age structure of your population. CMHC found that these demand-side factors accounted for most of home price growth across Canada, with the exception of Toronto. They estimate that less than half of the 40% gain in real average home prices between 2010 and 2016 can be attributed to economic factors in the GTA. A lesser 5% is attributed to speculation and domestic and foreign investment. The rest comes from geographic and regulatory constraints. Geographic constraints refer to the amount of land that can be developed in a region, while regulatory constraints include the red tape and costs builders face in the development stage.

In a less constrained environment, Toronto could have had 18,000 to 30,000 more units built between 2010 and 2016

In an unconstrained supply market, rising home prices should encourage more homebuilding activity. Supply constrained markets are ones that typically do not see a big enough rise in new home construction along with market activity. In other words, supply does not keep up with demand.

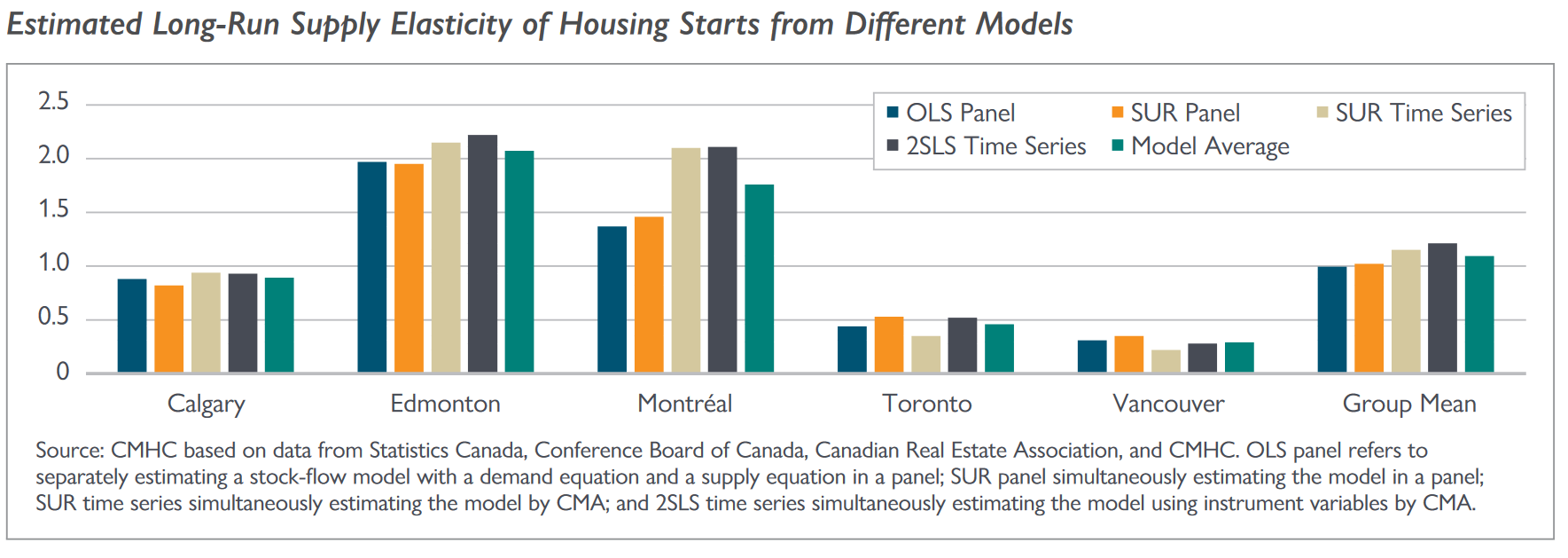

In their report, CMHC estimated how supply responds to price pressures in the five metro areas studied. Housing starts (the key measure of new supply) in Montreal, Calgary and Edmonton rise 1% to 2% for every 1% increase in home prices. However, for every 1% home price growth in Toronto and Vancouver, housing starts only grow by 0.5% and 0.3%, respectively.

We can put that in perspective by calculating just how much supply Toronto could have had, given similar supply responses in the other three major metro areas studied. Between 2010 and 2016, home prices in the GTA grew by 40% and housing starts averaged about 37,000 units per year. Had construction activity responded as it does in Montreal, Edmonton and Calgary, housing starts in Toronto would have averaged between 40K and 42K per year during that time. Over the six-year period, that would have added up to an additional 18K to 30K homes.

CMHC estimates of new home supply elasticities (chart taken directly from report):

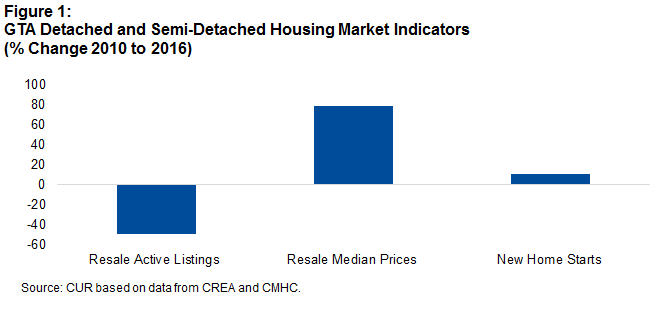

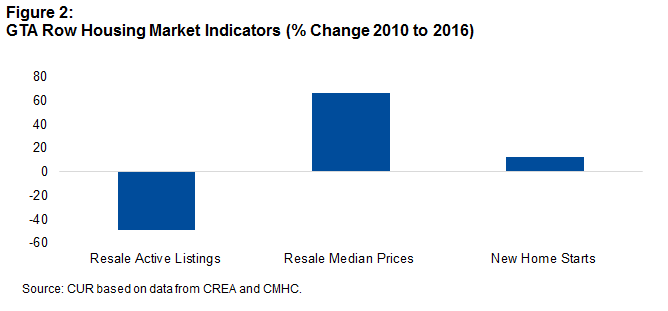

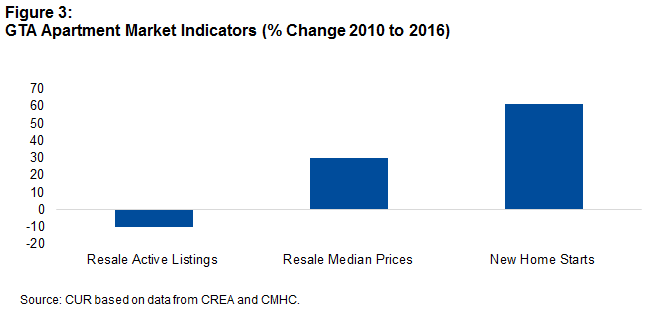

Supply was mostly constrained in ground-related housing

The supply constraints, however, have concentrated in markets tied to ground-related housing. CMHC briefly mentions that supply has responded far more strongly in the apartment market than for any other housing type in Toronto. This contrasts their findings that demand was strongest for ground related housing worth more than $1 million during the period studied. This highlights the demand-supply miss-match that has developed in Toronto. Figures 1, 2 and 3 at the end of this blog show just how stark the difference in supply response across housing types has been. New home construction grew by twice as fast as median prices in the apartment market but barely budged for detached, semi’s and rows. These supply constraints became quite evident in the existing home market where active listings fell most years between 2010 and 2016. Note that the data presented in figures 1, 2 and 3 are from a different source than that used in the CMHC story, but are still representative of the overall themes laid out in the report.

Regulatory burdens in Toronto hold back supply response

Some of the supply constraints in Toronto can be attributed to geography. Lake Ontario provides an example of a geographic constraint. There really isn’t much we can do about that. However, CMHC does highlight that there could be better options for revitalizing the current housing stock to create more density. Regulatory red tape such as long building permit time frames and rezoning requirements have also contributed to the rise in home prices.

For the most part, however, higher home prices have been a by-product of the Ontario Places to Grow Act. The sluggish responsiveness of the land use planning system, of which the Growth Plan is a dominant part, has held back the development of serviced sites needed to accommodate the demand pressures. As such, the Growth Plan has contributed to higher land values, which in turn is meant to encourage more density. Higher land values mean that homebuyers and builders must economize on land.

While this is true, density doesn’t have to mean high rise condo buildings only. However, the majority (75%) of Toronto is zoned for single-family homes. So density can only be achieved in small pockets of the city and requires high-rise developments, which do not offer a good substitute for ground related housing.

The Ontario Growth Plan stunts the filtering process, which impacts low income households the most

While density is a key objective of policy makers at all levels of government, the power of offering a mix of housing should not be underestimated. Providing a range of housing choice is actually a policy objective of the Ontario Growth Plan, but one that has not been met. By not providing high income households sufficient choice (or supply), policy makers have pushed them down the housing quality ladder. This means that high income individuals are paying for and occupying housing that would have been open to middle-income households. This in turn trickles down to low-income households, who are ultimately hurt the most by such supply constraints. Middle income households tie up housing that could have been used for low income households, making affordable housing significantly more difficult to provide. Low income households and renters ultimately hurt the most from such growth policies. The municipalities and province may need a new innovative way to build density, if housing affordability is actually their objective.

________________________________________________________________________

Diana Petramala is Senior Researcher at Toronto Metropolitan University’s Centre for Urban Research and Land Development (CUR) in Toronto.

_________________________________________________________________________________________________________