Toronto Homeowners Won’t Be Overburdened by a Proposed Property Tax Increase to Fund Infrastructure

By: Frank Clayton and Frances Grout-Brown

(PDF file) Print-friendly version available

December 16, 2019

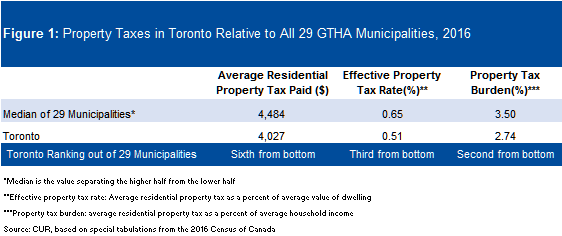

On February 28, 2019, CUR released a (PDF file) report comparing the property tax payments of home-owning households in the City of Toronto (“Toronto”) in 2016 to those in the 28 other municipalities in the Greater Toronto and Hamilton Area (“GTHA”). CUR found that Toronto had low property taxes in relation to all 29 GTHA municipalities in 2016 in terms of taxes paid, taxes in relation to market property value, and taxes in relation to household income.

Mayor Tory’s Proposal

On December 11, 2019, Toronto Mayor John Tory submitted a letter to the Executive Committee proposing an increase to the City Building Levy in order to raise the necessary funds for improving the existing transit system and building more affordable housing across the city. This proposed increase is an extension to the City Building Levy approved by City Council in 2017, which is a dedicated funding source from residential property taxes to be used for priority transit and housing capital projects. The levy approved in 2017 consisted of an annual increase to residential property tax of 0.5% between 2017 and 2021. The most recent proposal would increase property taxes 1% in 2020 and 2021 in addition to the existing 0.5% increment, and would continue at 1.5% annually from 2022 through 2025.

Toronto Has Room to Increase Homeowner Property Taxes – February 2019 CUR Property Tax Comparison Study

CUR’s earlier report concluded that Toronto has room to increase the average property tax rate by at least 20% on homes while still being in the middle range of the 29 GTHA municipalities. Looking at the average property tax levied on the average owner-occupied home (including condominiums) in Toronto compared to the other municipalities in the GTHA in 2016:

- The average property taxes in dollar terms in Toronto were some 10 percent less than those paid by the median-ranked municipality in the GTHA;

- The average effective property tax rate (taxes as a percent of market value) was 22 percent below the median for the 29 municipalities in the GTHA; and

- Toronto’s average property tax burden (taxes as percent of household income) was 21 percent below the median burden for the GTHA municipalities.

Mayor Tory’s Proposal Would Still Leave Toronto Property Taxes Amongst the Lowest in the GTHA

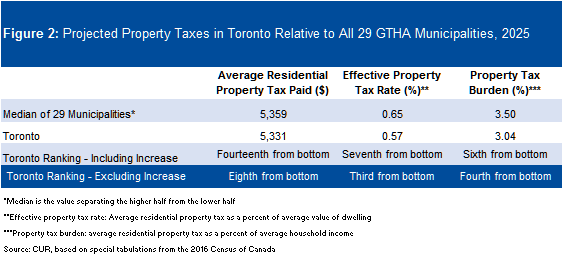

Forecasting the proposed increases to the City Building Levy until the proposed end year of 2025, the increase in property taxes in Toronto would bring the city closer to the mid-range of municipalities within the GTHA, as was recommended in our February report.

Overall, the proposed increases to residential property taxes in Toronto would bring the Toronto property tax payment in dollar terms up to the median level. Toronto’s taxes would still remain below median levels within the 29 GTHA municipalities for property tax as a percentage of market value (14% less) and for property tax as a percentage of household income (15% less).

Technical Note

Using data from the 2016 Census of Canada, CUR projected the average residential property tax paid, the effective property tax rate and the property tax burden based on the following methodology:

- An increase of 2% was applied annually until 2025, the end year of the City Building levy, to the average residential property tax paid, the average household income and the average property value for all 29 GTHA municipalities.

- An annual increase of 0.5% was added to the average property tax payment between 2017 and 2021, to incorporate the 0.5% increment already approved by City Council in 2017.

- The Toronto Mayor’s proposed increases of 1% in 2020 and 2021 to the existing 0.5% increment, and a continued 1.5% annually from 2022-2025, inclusively was added to the average property tax payment between 2020 and 2025.

Using this data, CUR compared the forecast average residential property tax paid, effective property tax rate, and property tax burden in Toronto with the other 28 municipalities in the GTHA.

_________________________________________________________________________________________________________

Frank Clayton is Senior Research Fellow at Toronto Metropolitan University's Centre for Urban Research and Land Development (CUR) in Toronto.

Frances Grout-Brown is a Research Assistant at Toronto Metropolitan University's Centre for Urban Research and Land Development (CUR) in Toronto.