Understanding TMU's Chart of Accounts

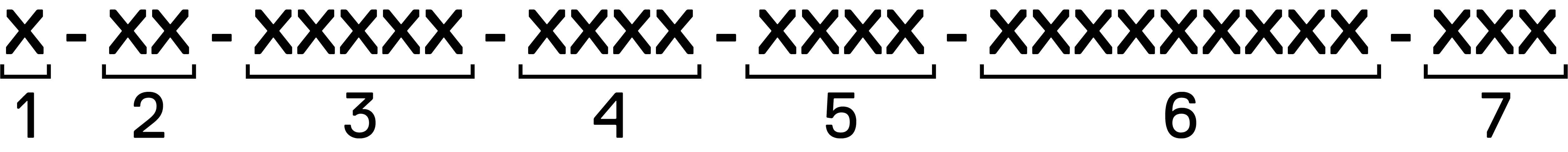

Toronto Metropolitan University uses a chart of accounts that consists of seven segments. When each segment is populated with a value within its allocated value range, it results in a 28-digit distribution code. Each segment must be completed in order to inquire or run reports in the Financial Information System (FIS or Oracle).

Distribution code segments

Use the following table to determine what each segment of TMU’s 28-digit distribution code represents, as well as the range of values applicable to that segment.

28 digits each represented by an "x" and split into seven segments where segment 1 has 1 digit; segment 2 has 2 digits; segment 3 has 5 digits; segment 4 has 4 digits; segment 5 has 4 digits; segment 6 has 9 digits; and segment 7 has 3 digits.

Segment |

Category |

Description |

Value range |

1 |

Company |

The company segment represents Toronto Metropolitan University. We have only one value and it is 1. |

1 |

2 |

Fund |

The fund segment represents various sources of university funding. |

11 - 85 |

3 |

Cost centre |

The cost centre segment represents the various departments, units or projects within the university. |

00001 - 99999 |

4 |

Account |

The account segment represents the total assets, liabilities, revenues and expenses (e.g. office supplies, travel expenses). |

0001 - 9999 |

5 |

Activity |

The activity segment allows departments an additional method for dividing revenue and expenses, e.g. by semesters or employee groups. |

0000 - 9999 |

6 |

Employee or course |

The employee/course segment is used by The G. Raymond Chang School of Continuing Education to expense transactions to the courses they offer. It is also used by faculties to track expenses down to the employee level, normally as a result of professional development or internal research. |

000000000 - 999999999 |

7 |

Location |

The location segment is not in use. The only possible value is 000. |

TMU receives income from a variety of sources. This income is then allocated accordingly into categories called funds, which can be identified as either operating funds and non-operating funds.

The following table shows which attributes to enter in the chart of accounts. Here, we explain each column:

- Fund description: Types of reports available.

- Fund summary: Entering a fund summary code tells the system which fund you’d like to view in a summary format.

- Fund: Entering a fund code tells the system you’d like to look at a fund in detail. Leaving this field blank will show you both summary and detailed formats.

- Amount type: Entering an amount type code indicates whether you’d like to look at a fund’s activity from the start of the fiscal year (year-to-date or YTDE) or from the beginning of the project’s start (project-to-date or PJTD).

| Fund description | Fund summary | Fund | Amount type |

| Ancillary | AN | 14, 15, 16 | YTDE |

| Operating | OP | 11, 13 | YTDE |

| PACAR | PR | 36 | YTDE |

| Prof. Devlp | PD | 12 | YTDE |

| Capital project | CP | 84 | PJTD |

| Miscellaneous | MS | 35, 37, 38, 39 | PJTD |

| Project | PJ | 51 | PJTD |

| Special activity | SA | 33, 34 | PJTD |

| Trusts | TR | 60, 61, 62 | PJTD |

For more information, visit the Funds Available page.

The following value ranges for the account segment of TMU’s distribution code can help you identify the account type. For more information, including a list of commonly used account codes, visit the Account Codes page.

Account type |

Value range |

Revenue |

5000-5999 |

Salary (payroll) |

6000-6899 |

Benefits |

6900-6999 |

Non-salary |

7000-8999 |

Questions?

If you have any questions about TMU’s chart of accounts, please contact your financial advisor.