Statistics Canada Vacant Residential Land Estimates for Toronto and Ottawa Metropolitan Areas: A Baby Step Forward

By: Frank Clayton, Senior Research Fellow

January 24 , 2024

(PDF file) Print-friendly version available

Executive Summary

This blog assesses the credibility of the recently released Statistics Canada vacant residential land acreage data by comparing it to existing residential land inventory data sources for the Toronto and Ottawa census metropolitan areas (CMAs).1 Two comparison sources are examined: a recent statistical compilation of vacant residential land in the Greater Toronto Area (GTA) municipalities undertaken by Malone Given Parsons (MGP) and a comprehensive vacant land survey conducted annually by the City of Ottawa. In all data sources, the inventory is limited to greenfield land.

Highlights:

- There is a disparity between the StatCan and MGP residential land inventories for the Toronto CMA, with StatCan's vacant land inventory being much larger. MGP estimates the vacant land inventory in the GTA to be 57,650 acres or 44% of StatCan's 131,000 acres.

- There is an even more sizable disparity between the two estimates for the City of Ottawa. The City of Ottawa estimates its vacant land inventory to be 3,825 acres or just 4% of StatCan's 123,000 acres.

Part of the difference between the data sources is that the StatCan land relates to gross land area (i.e., developable and non-developable)land while the local sources encompass developable land only.

Other than the gross-to-net differences, there are no apparent reasons for the marked disparity between StatCan's estimates and the results of locally generated residential land inventories, which suggest the StatCan estimates are overstated.2

StatCan's interest in collecting statistics on vacant residential land is welcome. Still, it must recognize that meaningful data will require a more rigorous and detailed approach and a much better understanding of land use planning structures. The inventory must incorporate the planning and servicing status of vacant land. In particular, vacant lands ready for residential development must be separated out (short-term or shovel-ready lands). In Ontario, short-term-lands include draft approved plans of subdivision and unbuilt lots in registered plans of subdivisions on greenfield lands

It is recommended that StatCan should launch a research inquiry to improve its understanding of what is included in the vacant residential land estimates obtained from its data sources (for Ontario, MPAC and Teranet) and how they relate to vacant land estimates as used in land use planning.

Background

There is a growing awareness of the need for increased production of all housing types. However, in most Ontario municipalities, there is limited data on the available buildable land inventory to assess whether increased housing production is possible.

A significant gap in our housing knowledge is the lack of comprehensive data on the inventory of vacant residential land that is designated, suitably zoned for viable development with hard services readily available (i.e., short-term supply)3, and land at various stages of the planning and development pipeline. These developable sites are found on greenfields (e.g., farmland) and in built-up urban areas through redevelopment and intensification.

Statistics Canada (StatCan) now releases rudimentary information on vacant residential land as part of its Canadian Housing Statistics Program, initiated with the Canada Mortgage and Housing Corporation (CMHC's) support in 2017. The initial data from this program shed light on the ownership of vacant residential properties in non-individual ownership in British Columbia, Ontario, and Nova Scotia.4 Practically, this information is of limited use for housing market analyses as does not provide insight into the quantity of vacant residential land and how it changes. Nor does it show the amount of vacant residential land available by planning status - e.g., how much of the vacant land is short-term land available for the building of homes on it.

More recently, StatCan released data on the acreage of vacant residential land in five census metropolitan areas (CMAs).4 Although limited in scope, this hopefully is the first step to creating a vacant land database needed for meaningful research and understanding of the vacant land inventory available for developing new housing.

This blog assesses the credibility of the StatCan vacant land acreage data by comparing it to existing residential land inventory data sources for the Toronto and Ottawa CMAs.5 In all data sources, the land inventory is limited to greenfield land.

In examining the StatCan data, it is important to remember that this is the national statistical agency's first attempt at quantifying the greenfield land available for housing construction. It can be likened to birth, the start of something that hopefully will grow into a comprehensive dataset of vacant residential land designated, suitably zoned for viable development with hard services available, and including land at various stages of the planning and development pipeline by CMA and component municipality. An optimal land dataset would include vacant land by type of housing for both greenfield land and viable zoned sites in built-up urban areas by planning stage and servicing status.

Compiling an ongoing, national, comprehensive, and consistent database of residential land ready for development by stages in the planning pipeline is a complex task. Planning and development approval systems vary by province, and there are peculiarities by municipality with a province. Moreover, the dataset should cover entire housing market areas. CMAs are approximations for housing market areas since they are based on commuting patterns between where most residents live and work.

A technical note at the end of this blog outlines definitions of vacant residential land used in the StatCan estimates and locally available datasets. Two comparison sources are examined: a recent statistical compilation of vacant land in many municipalities in the Greater Golden Horseshoe (GGH), including municipalities in the Greater Toronto Area (GTA), undertaken by Malone Given Parsons (MGP)6 and a comprehensive vacant land survey conducted annually by the City of Ottawa.7

The StatCan estimates of vacant residential land inventory in the Toronto and Ottawa CMAs and the cities of Toronto and Ottawa

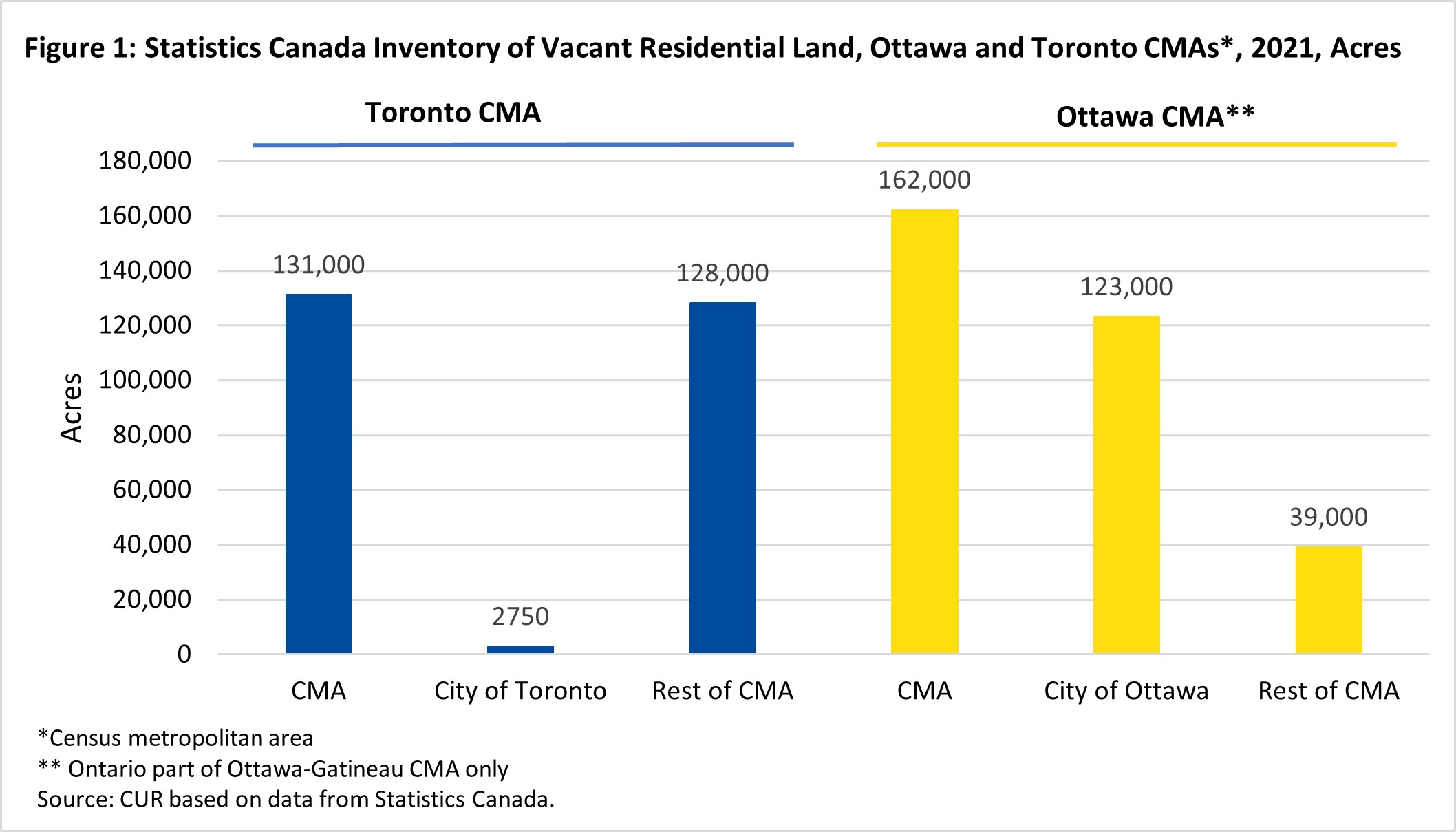

Figure 1 presents the StatCan estimates of vacant residential land in 2021 for the Toronto and Ottawa CMAs, their central cities, and the portions CMAs other than central cities.

Highlights:

- Surprisingly, the Ottawa CMA has a larger inventory of vacant residential land than the Toronto CMA despite Toronto's population being more than four times Ottawa's. The Ottawa CMA's vacant residential land inventory is 162,000 acres, 31,000 more acres than Toronto's 131,000 acres (24% larger).

- Virtually all the Toronto CMA's land inventory is in municipalities outside the city of Toronto. Less than 3,000 acres of the CMA's vacant land is in Toronto, or 2% of the total inventory in the CMA.

- In contrast, most of the Ottawa CMA's vacant land inventory is within the boundaries of the city of Ottawa. The Ottawa CMA's vacant land inventory is concentrated within Ottawa, home to 123,000 of the CMA's 162,000 acres (76%).

Assessment

A red flag is raised with the estimated vacant residential land inventory in the Ottawa CMA, which is shown to be 24% higher than in the Toronto CMA,given the wide difference in size of the two CMAs. The reliability of these estimates is assessed in the next section of this note.

Almost all the vacant residential land inventory in the Toronto CMA is in the surrounding 905 municipalities because the city of Toronto is built out. The majority of CMA population growth is also outside the city. In the 1950s, the boundaries of the now amalgamated city of Toronto (formerly the municipality of Metropolitan Toronto) were the same as the CMA boundaries. Hence, Toronto had a plentiful supply of greenfield land then. However, since the early 1960s, growth has spilled over increasingly to the 905 municipalities in the CMA as currently defined, and Toronto exhausted its greenfield land inventory many years ago.

The amalgamated city of Ottawa, the region of Ottawa-Carleton before 2001, encompasses a much larger share of its CMA than Toronto. Ottawa still has a sizeable inventory of greenfield land within its boundaries.

Comparison of the StatCan estimates with locally generated vacant residential land estimates

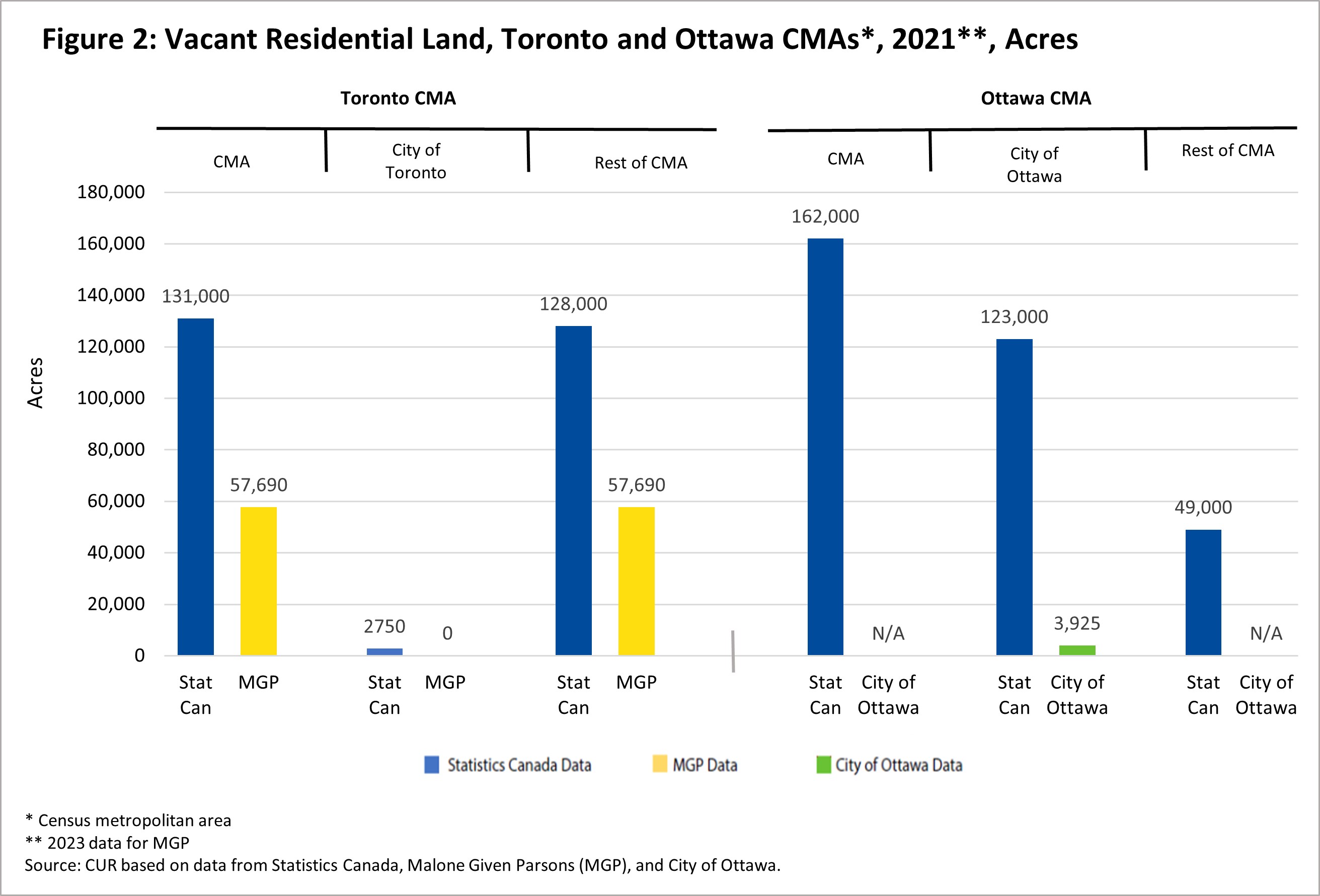

The StatCan estimates of vacant residential land in the two CMAs are compared with local source estimates, which are the product of comprehensive and rigorous collection methodologies – see Figure 2.

For the Toronto CMA, the comparator is the detailed vacant land inventory prepared in 2023 by the firm of Malone Given Parson (MGP) covering all the municipalities in the Greater Toronto and Hamilton Area (GTHA) and selected other municipalities that are part of the Greater Golden Horseshoe (GGH).8 Hamilton has been removed from the GTHA in the estimates here.9

For the Ottawa CMA, the comparator is the 2021 vacant residential land survey conducted by the City of Ottawa planning staff. The comparison is limited to inventories in the city of Ottawa.10

Highlights:

- There is a disparity between the StatCan and MGP vacant residential land inventories for the Toronto CMA, with StatCan being much larger. MGP estimates the vacant land inventory in the GTA to be 57,650 acres or 44% of StatCan's 131,000 acres.

- There is an even more sizable disparity between the two estimates for the City of Ottawa. The City of Ottawa estimates its vacant land inventory to be 3,825 acres or just 4% of StatCan's 123,000 acres.

Assessment

The disparity between the Statistics Canada estimates and the two comparator land databases is not readily explainable. Statistics Canada states it bases its estimates on information provided by the Municipal Property Assessment Corporation (MPAC) and Teranet. Searching the web for more details on MPAC's coding of residential vacant lands provided nothing of substance to help explain the difference.

Statistics Canada estimates encompass developable and non-developable lands (often called gross land area). In contrast, MGP clearly states that their estimates include only developable acreages. They exclude natural heritage features and areas and major infrastructure corridors, including highways, railways, electricity transmission lines and pipelines.

Research conducted by the Neptis Foundation suggests a 71% ratio of developable to combined developable and non-developable vacant residential land might be reasonable in the GTHA.11 Applying this ratio to StatCan's 131,000 acres yields an estimated 93,000 acres for MGP, which is still 38,000 acres short of the StatCan estimate.

Ottawa's vacant residential land report does not provide information on gross land acres. However, a separate report from the City analyzes net-to-gross land area ratios in five urban expansion study areas.12 It concluded that a net-to-gross ratio of 50% is reasonable for new greenfield complete communities. Doubling Ottawa's vacant land estimate results in 7,850 gross acres, a tiny fraction of the StatCan estimate of 123,000.

Conclusions and Recommendation

Other than the gross-to-net differences, there are no apparent reasons for the marked disparity between StatCan's estimates and the results of locally generated residential land inventories, which suggest the StatCan estimates are overstated. It is recommended that StatCan launch a research inquiry to improve its understanding of what is included in the vacant residential land estimates obtained from its data sources (for Ontario, MPAC and Teranet) and how they relate to vacant land estimates as used in land use planning.

The agency should also recognize that providing reliable estimates of the gross vacant residential land area is the first step in identifying lands ready for new development.

For example, the MGP report disaggregates its vacant developable land estimates into four categories:

- No planning application

- Applications in progress

- Draft approved plan of subdivisions

- Registered plan of subdivision

A recent CUR report highlights the importance of having an ample supply of shovel-ready land i.e., sites in greenfields and built-up areas ready to be built on with appropriate zoning and servicing in place.13

StatCan's interest in collecting statistics on vacant residential land is welcome. Still, it must recognize that meaningful data will require a more rigorous and detailed approach and a much better understanding of land use planning structures. The inventory must incorporate the planning and servicing status of vacant land. In particular, vacant lands ready for residential development (short-term or shovel-ready lands) must be separated out from land that needs zoning/servicing which will take much longer to develop.

Technical Note: Definitions of Vacant Residential Land

This note summarizes the definition of vacant residential land employed by StatCan, MGP, and the City of Ottawa.

Statistics Canada

Statistics Canada defines vacant land as a property on which there are currently no residential structures but where one can be built.

Malone Given Parsons (MGP)

MGP defines vacant land as lands that are currently unbuilt, including lands that may have an Application in Progress, that is Official Plan (OP) Designated or has No Approved Planning as defined by MGP. The italicized terms are defined as:

- Application in Progress: Land, according to the most recent subdivision status mapping available by municipality, that has a subdivision application submitted but not yet approved.

- OP Designate: Refers to vacant land with an urban land use designation according to the lower tier/single-tier Official Plan/Secondary Plan land use schedules.

- No Approved Planning: Land without an approved urban land use designation according to lower-tier/ single-tier Official Plan/Secondary Plan land use schedules.

The vacant land estimates relate to community area land, including land for housing and local employment. Non-developable lands are excluded. These exclusions include natural heritage systems and features, major infrastructure, cemeteries, major highways, railways, and rights-of-way for electricity transmission lines and pipelines.

City of Ottawa

The City of Ottawa inventory report defines vacant residential land as “lands approved for residential development based on the most detailed, approved planning document for the subject parcel at time of publication. In order of detail, from the most specific to the most general, planning approvals range from site plans, plans of subdivision and condominium, the zoning by-law, Community Design Plans and the Ottawa Official Plan."

Endnotes

[1] The Ontario part of the Ottawa-Gatineau CMA only.

[2] In previous CUR reports this land inventory is referred to as shovel-ready or short-term land inventory. Hard services refers to infrastructure such as sewer, water, and roads.

[3] Elizabeth Koulouris and Andrew Scott. “Residential Property in British Columbia, Ontario and Nova Scotia: Overview of Non-Individual Ownership.” CMHC Housing Market Insight. February 2019.

[4] Florian Mayneris and Radu Andrei Pârvulescu. “A Toolkit for Understanding Housing Supply.” Statistics Canada. October 25, 2023.

[5] The Ontario part of the Ottawa-Gatineau CMA only.

[6] Malone Given Parsons. (2023). “Greater Toronto & Hamilton Area, Simcoe County, Barrie, Orillia & Waterloo Region”. December 2023.

[7] City of Ottawa Planning, Real Estate and Economic Development. “Greenfield Residential Land Survey Mid-2021 Update.” September 2022.

[8] Malone Given Parsons. (2023).

[9] The GTA covers a larger area than the Toronto CMA. All things being equal, its vacant land inventory should be larger than the CMA’s.

[10] City of Ottawa (September 2022)

[11] Zach Taylor and John Van Nostrand. “Shaping the Toronto Region, Past, Present, and Future: An Exploration of the Potential Effectiveness of Changes to Planning Policies Governing Greenfield Development in the Greater Golden Horseshoe - The Development Scenario Model (Appendix C)”. Neptis Foundation, September 2008. The Neptis study examines the land uses in six case communities. It calculates low (90%), median (71%) and high (61%) hypothetical scenarios of the ratio of developable to gross land area. The median scenario is used here.

[12] Planning, Infrastructure and Economic Development Department. “Residential Growth Management Strategy for the New Official Plan - Appendix 4: Analysis of Residential Net to Gross Ratios in the City of Ottawa.” March 2020.

[13] Frank Clayton and David Amborski. “Expanding Housing Supply and Improving Housing Affordability in the GGH Are Pipedreams Without an Ample Inventory of Shovel-Ready Sites.” CUR. May 25, 2023.